What is a SIPP?

A SIPP gives you more control over how your pension is invested and more flexibility when you retire. Whether you want ethical funds, commercial property, or just lower fees, a SIPP could be a smart move.

A SIPP works much like a standard personal pension. You make contributions, receive tax relief, and grow your savings for retirement. But unlike most pensions, a SIPP gives you much more control over how your money is invested.

But with more choice comes more responsibility. That’s why getting the right advice is essential.

What are the benefits of a SIPP?

Is a SIPP right for you?

Common reasons people look for SIPP advice:

- You’ve got multiple pensions and want to combine them

- You want more control over how your pension is invested

- You’re approaching retirement and want to use drawdown

- You’ve got a large pension pot and need expert guidance

- You want to leave more to your family in the future

Should you get advice before setting up a SIPP?

A SIPP is ideal for people who want flexibility and more involvement in managing their retirement savings. But with that flexibility comes responsibility and getting advice from an FCA-regulated financial adviser can help you:

- Decide if a SIPP is suitable for your goals and risk tolerance

- Choose a provider with the right fee structure and investment access

- Transfer old pensions without losing valuable benefits

- Avoid tax traps and plan your withdrawals efficiently

SIPPs offer flexibility but they’re not for everyone. The wrong move could cost you thousands in tax, fees, or lost guarantees. Our advisers will help you make smart tax decisions and help you avoid common pitfalls.

How a SIPP works

- Open a SIPP

This can be done through a provider or with help from a financial adviser. Make sure you compare providers before committing as you could save money or get better investment tolerances. You can transfer in old pensions or start contributing from scratch. - Make contributions

You can contribute up to £60,000 per year (or 100% of your earnings, whichever is lower). You’ll usually receive 20% tax relief automatically, and higher earners can claim more via self-assessment. - You choose where to invest

Unlike traditional pensions with limited fund choices, SIPPs let you choose from a wide range of investments, including: Shares, Funds and ETFs, Bonds or Commercial property (in some SIPPs). - Your pension grows Tax-Free

Investments in a SIPP grow free from income tax and capital gains tax, helping you build a larger retirement pot over time. - You access it from Age 55 (57 from 2028)

When the time comes, you can take: 25% as a tax-free lump sum and the rest as income through drawdown, lump sums, or annuity purchase. Your withdrawals beyond the tax-free portion are taxed as income.

Things to consider before taking a SIPP

- Investment experience required

Not everyone feels comfortable managing their portfolio. Make sure you have considered your risk tolerance and feel comfortable making decisions. - Platform and fund charges can vary

SIPP providers typically charge platform fees, and the funds or investments you choose may also carry management or transaction fees. Even small percentage differences can significantly reduce your pension pot over time, especially on large balances or over long periods. - Annual allowance and MPAA

You can usually contribute up to £60,000 per year into pensions and receive tax relief (your annual allowance). However, if you’ve already started drawing income from a SIPP (beyond the tax-free lump sum), your allowance may drop to just £10,000 per year - this is called the Money Purchase Annual Allowance (MPAA).

Why use our service?

Making decisions about your pension is important, and getting the right advice can make all the difference. Our service connects you with trusted, FCA-regulated advisers who are ready to help you navigate your pension choices.

- Free and impartial - There’s no charge for using our service — we’ll match you with a qualified adviser at no cost to you.

- Quick and convenient - It takes less than a minute to be matched with an adviser who understands your needs.

- Advisers near you - Our nationwide network means you’ll be connected with someone local, so you can choose how and when to speak.

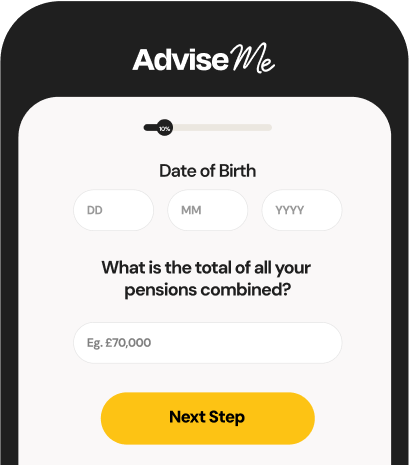

How it works?

Our expert adviser network

All of the advisers we work with are FCA-authorised and regulated.

*Over £26.6 billion in lost pensions highlights need for retirement planning — Peter Lawson Financial News, November 2023. Read the full article