Access your retirement income with confidence

Pension drawdown allows you to access your defined contribution pension pot flexibly. You will be able to take your pension income either as regular income, lump sums, or a combination. It gives you greater control over how and when you use your pension savings. Simply put, the benefits of drawdown give you:

- Flexibility over how income is taken

- Investment growth potential

- Ability to pass on any remaining funds

Whether you're interested in drawdown, annuities, or a mix of retirement income strategies, our FCA-regulated advisers are here to guide you. With tailored advice, you can make informed decisions for your financial future.

Why Choose Pension Drawdown?

How does drawdown work?

-

You keep your pension pot invested, so it has the potential to grow even after you start taking money out.

-

You can take up to 25% of your pension tax-free (usually as a lump sum or as part of your income).

-

The rest stays invested, and you can withdraw money when you need it either as regular income or lump sums.

-

The amount you take, and when you take it, is up to you giving you flexibility in retirement.

-

Any money left in your pot can usually be passed on to your beneficiaries, often tax-efficiently.

So why choose drawdown?

- Control: You’ll control your income based on your lifestyle and cash flow needs.

- Growth Opportunity: Keeps funds invested, giving your money a chance to grow tax-efficiently.

- Estate planning: Drawdown gives you options to pass on unused pension with minimal tax.

- Tax Efficiency: An adviser ensures withdrawals are structured to minimise tax liabilities.

Things to consider:

Pension drawdown offers flexibility, but it also carries risks. Here’s where expert support matters:

- Market risk - Investments can underperform, reducing your pension pot.

- Withdrawal strategy - Taking too much too soon can deplete your savings.

- Tax planning - Without advice, you may inadvertently trigger high tax bills.

- Product missteps - Certain drawdown products may carry higher costs or unsuitable terms.

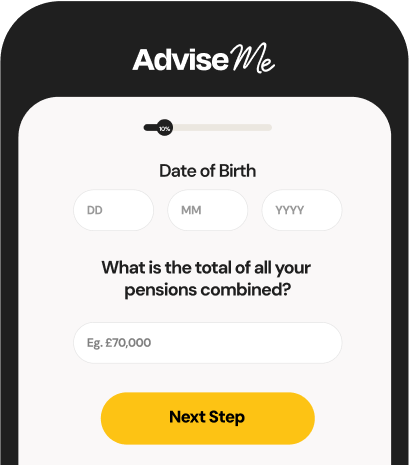

How it works?

Why use our service?

Making decisions about your pension is important, and getting the right advice can make all the difference. Our service connects you with trusted, FCA-regulated advisers who are ready to help you navigate your pension choices.

- Free and impartial - There’s no charge for using our service. We’ll match you with a qualified adviser at no cost to you.

- Quick and convenient - It takes less than a minute to be matched with an adviser who understands your needs.

- Advisers near you - Our nationwide network means you’ll be connected with someone local, so you can choose how and when to speak.

Our expert adviser network

All of the advisers we work with are FCA-authorised and regulated.

Frequently asked questions

Pension drawdown is a way of taking money from your pension pot while keeping the rest invested. It gives you flexibility to choose when and how much income you take, rather than locking everything into a fixed annuity.

Usually, you can take up to 25% of your pension pot tax-free. The rest is taxable as income, so it’s important to get advice on how to withdraw in the most tax-efficient way.

Not always. Drawdown carries investment risk, if markets fall or you withdraw too much too quickly, your pot could run out. An adviser can help you decide if drawdown, an annuity, or a mix of both is better for your needs.

-

Investment values can go down as well as up.

-

You could run out of money if withdrawals aren’t managed carefully.

-

Your income isn’t guaranteed, unlike an annuity.

That’s why getting professional advice is so important.

Yes. Many people choose a blend using part of their pension for the security of an annuity and the rest in drawdown for flexibility.

While it’s not always legally required, it’s strongly recommended. An FCA-regulated adviser will help you weigh up your options, plan withdrawals, and avoid paying more tax than necessary.