Your pension is a key part of your financial future

Understanding your pension options can feel overwhelming, but it doesn't have to be. We're here to make it simple and stress-free.

When you reach retirement age, you’ve got choices about how to use the money you've saved in your pension. Knowing the differences—and what’s best for you—is key to making the most of it.

Understanding some of your options:

- Leave it invested

You don’t have to take your pension right away. You can keep it where it is, giving it a chance to grow. - Take a lump sum

You can take up to 25% of your pension pot tax-free. You might choose to take it all at once or in chunks. - Drawdown

Keep your pension invested and take money out as and when you need it— offers flexibility with some risk. - Annuity

Exchange your pension for a guaranteed income for life by buying an annuity. It’s peace of mind with less flexibility. - Mix and match

Combine different options to suit your lifestyle and financial needs.

Why take advice?

An FCA-regulated financial adviser is there to make things easier and clearer. They can:

- Review your pension pot and explain your options in plain English

- Help you understand the tax implications of taking money from your pension

- Tailor a retirement plan based on your income needs and goals

Why use our service?

Making decisions about your pension is important, and getting the right advice can make all the difference. Our service connects you with trusted, FCA-regulated advisers who are ready to help you navigate your pension choices.

- Free and impartial - There’s no charge for using our service — we’ll match you with a qualified adviser at no cost to you.

- Quick and convenient - It takes less than a minute to be matched with an adviser who understands your needs.

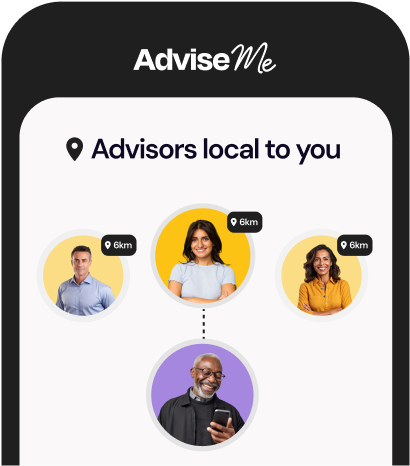

- Advisers near you - Our nationwide network means you’ll be connected with someone local, so you can choose how and when to speak.

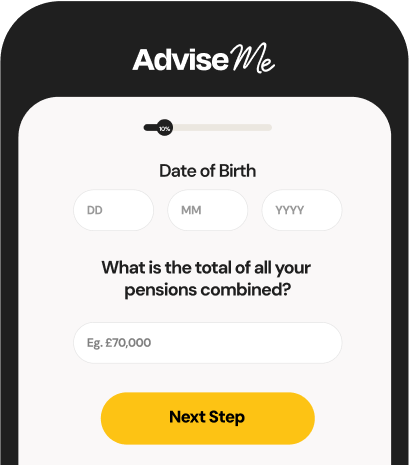

How it works?

Our expert adviser network

All of the advisers we work with are FCA-authorised and regulated.

*According to an article from ilc.org.uk