Take control of your retirement with Independent Pension Advice

Whether you’re planning for retirement, consolidating multiple pension pots, or exploring drawdown and annuity choices, the right advice makes all the difference. We’ll match you with a qualified and impartial pension adviser trusted, regulated, and ready to support your goals.

84% of people who received professional pension advice report improved peace of mind, and 90% say it enhanced their quality of life.*

Why? Independent advisers are not tied to one provider. They’ll take the time to understand your personal objectives and suggest the best solutions across the entire market. That means:

- Unbiased recommendations tailored to your needs, not a product.

- Full market access, explore all pension options, not just one provider.

- Peace of mind with advice that’s FCA-regulated and always in your best interest.

Why get Independent Pension Advice?

Just like in financial planning, a regulated independent pension adviser is your long-term ally, helping you navigate decisions such as:

- Making sense of your existing pension options

- Combining pensions for clarity and cost savings

- Choosing between drawdown and annuity for your retirement income

- Maximizing tax efficiency and protecting your future

- Navigating complex rules like high-value pots or pension transfers

They listen to where you are now and where you’d like to be and guide you there with care and expertise.

The advice difference:

- 33% felt more confident

- 26% worried less about money

- 25% felt less vulnerable

- 20% even slept better at night

Whether it’s helping you plan for retirement, deal with unexpected life changes, or simply make the most of your pension, financial advice makes a real difference.*

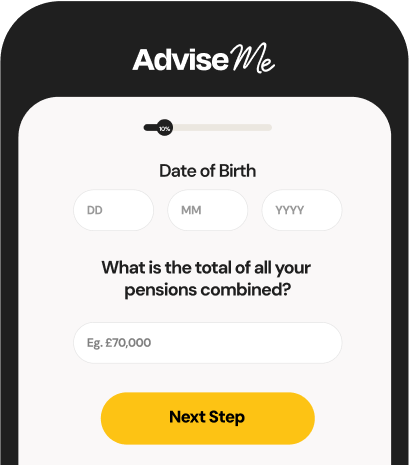

How our service works

Why use our service?

Making decisions about your financial future is important, and getting the right advice can make all the difference. Our service connects you with trusted, FCA-regulated advisers who are ready to help you navigate your financial planning journey.

- Free and impartial - There’s no charge for using our service. We’ll match you with a qualified adviser at no cost to you.

- Quick and convenient - It takes less than a minute to be matched with an adviser who understands your needs.

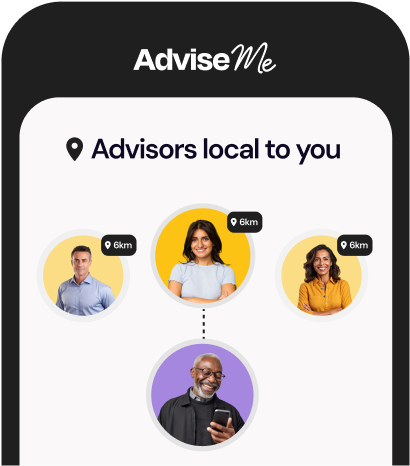

- Advisers near you - Our nationwide network means you’ll be connected with someone local, so you can choose how and when to speak.

Our expert adviser network

- A history of delighted customers and outstanding service.

- Consistently approachable and responsive, so you never feel ignored.

- All of the advisers we work with are FCA-authorised and regulated.

- Provide service with honesty, reliability and respect.

- We’ve a long history of connecting customers with local experts.

- We work harder and smarter behind the scenes to find your expert match.

*Based on a report conducted by St. James's Place Wealth Management Plc in 2024

Frequently asked questions

It means your adviser isn’t tied to one provider or product. Instead, they can recommend the best options across the whole market, based entirely on your needs.

If you’re making decisions about consolidation, drawdown, annuities, or transfers, advice can help you avoid costly mistakes and maximise your retirement income. In some cases, such as transferring a final salary pension, regulated advice is a legal requirement.

Your first consultation is free and without obligation. If you choose to go ahead, your adviser will explain all fees clearly before you make any decisions.

All of the advisers we work with are governed by FCA rules. Their firms are authorised and regulated by the Financial Conduct Authority (FCA). This means both they and their firms must follow strict professional standards, with a legal duty to:

-

Treat you fairly

-

Provide clear, good-value advice

-

Put your financial wellbeing first

With FCA oversight, you can feel confident that the advice you receive is designed to help you achieve the best possible outcomes.

You can choose what works best for you. Many advisers offer secure video or phone consultations, while others are happy to meet face-to-face.

A pension adviser can support you with:

-

Review your existing pensions

-

Help you consolidate multiple pots

-

Explain drawdown and annuity options

-

Maximise your tax efficiency

-

Support you with planning for retirement income

Yes. We don’t charge you to be matched with an adviser. You’ll get a free initial consultation, and only pay fees if you decide to go ahead with the adviser’s recommendations.