Considering a Pension Annuity?

When it comes to turning your pension savings into a reliable income, one option you might want to think about is a pension annuity.

Put simply, an annuity takes the money you’ve saved and turns it into a guaranteed income — usually for the rest of your life.

Why Choose an Annuity?

An annuity usually works by:

- You exchange some (or all) of your pension pot for a regular, secure income.

- Once set up, the income is guaranteed — no matter what happens to markets or interest rates.

- There are different types of annuities, so you can choose one that suits your needs — for example, one that protects your spouse after you pass away, or one that increases each year to keep pace with inflation.

So why choose an annuity?

- Security: You’ll know exactly how much money you’ll receive, and when.

- Peace of mind: You won’t need to worry about stock market ups and downs affecting your income.

- Simplicity: Once your annuity is set up, there’s very little to manage.

- Tailored to you: You can choose options like joint-life cover, income increases, or protection against inflation.

Things to consider:

Taking out an annuity is a big decision — and usually, it’s irreversible. That's why it's important to:

- Compare different annuity providers (rates can vary!)

- Consider your health and lifestyle (some providers offer enhanced rates if you have certain medical conditions)

- Think about whether you want an income that stays the same or increases over time

- Understand how your choice fits with your overall retirement goals

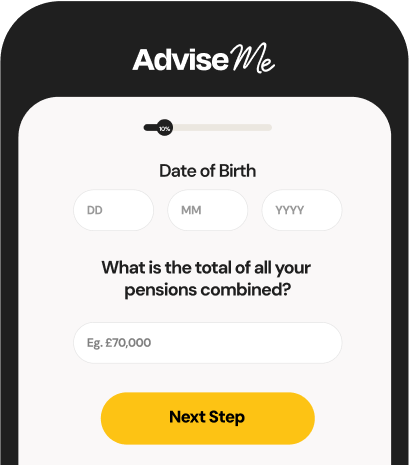

How it works?

Why use our service?

Making decisions about your pension is important, and getting the right advice can make all the difference. Our service connects you with trusted, FCA-regulated advisers who are ready to help you navigate your pension choices.

- Free and impartial - There’s no charge for using our service — we’ll match you with a qualified adviser at no cost to you.

- Quick and convenient - It takes less than a minute to be matched with an adviser who understands your needs.

- Advisers near you - Our nationwide network means you’ll be connected with someone local, so you can choose how and when to speak.

Our expert adviser network

All of the advisers we work with are FCA-authorised and regulated.

*According to an article from ilc.org.uk