Thinking of combining your pension pots?

If you’ve built up multiple pensions over the years, it can be difficult to keep track and even harder to know if they’re working for you.

Consolidating your pensions could help reduce fees, simplify your planning, and give you a clearer picture of your retirement income. But it’s not always the right option for everyone.

We’ll match you with a fully FCA-regulated pension adviser who can review your existing pots, explain your options in plain English, and help you decide if consolidation makes sense for your circumstances.

Why get advice when it comes to consolidating your pensions?

Consolidation isn’t right for everyone and some pensions come with valuable benefits you won’t want to lose. That’s why it’s important to get personalised advice from someone who’s FCA-authorised to help.

Here's some reasons why people choose to consolidate their pension pots:

- To make them easier to manage in one place

- To reduce fees across older or less competitive plans

- To access better investment options

- To get a clearer view of retirement income

- To prepare for drawdown or annuity

Why you should consider combining your pensions

- Easier to manage

You can focus on one combined pension, you don't have to worry about managing lots of pensions with different providers. - Clearly track your pension performance

See how your total pension pot is performing and where it is invested, all in on place. - You could pay lower fees

Some older pensions may have higher charges, so you could save by transferring your pensions.

Why use our service?

Making decisions about your pension is important, and getting the right advice can make all the difference. Our service connects you with trusted, FCA-regulated advisers who are ready to help you navigate your pension choices.

- Free and impartial - There’s no charge for using our service — we’ll match you with a qualified adviser at no cost to you.

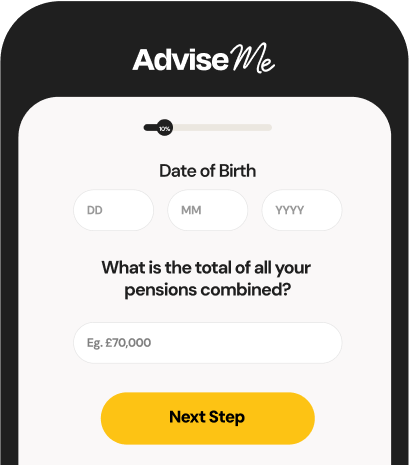

- Quick and convenient - It takes less than a minute to be matched with an adviser who understands your needs.

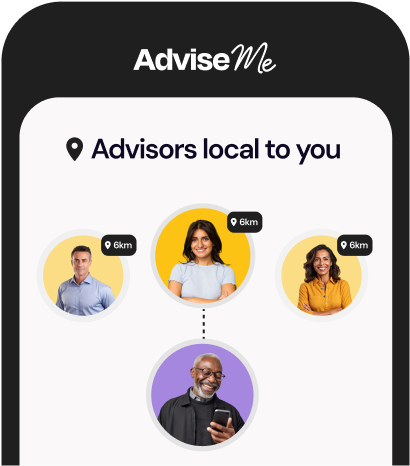

- Advisers near you - Our nationwide network means you’ll be connected with someone local, so you can choose how and when to speak.

How it works?

Our expert adviser network

All of the advisers we work with are FCA-authorised and regulated.

*Over £26.6 billion in lost pensions highlights need for retirement planning — Peter Lawson Financial News, November 2023. Read the full article