Remortgaging made simple

If your fixed-rate mortgage is coming to an end or you're paying more than you should it could be the right time to remortgage. Switching to a better deal might save you hundreds each month, help you fix your payments for peace of mind, or even release equity for things like home improvements or big life plans.

Our expert partner mortgage advisers will compare remortgage deals from across the market to find the one that fits your goals and handle the paperwork from start to finish. You’ll get clear, expert advice with no pressure, no hidden fees, and no jargon; just a better mortgage deal and a smoother process. Don’t risk rolling onto a costly standard variable rate. Let’s find you something better.

Why get mortgage advice?

Mortgages can be complex. The right advice makes a huge difference. Whether you’re new to mortgages or just want reassurance you’re getting the best deal, expert advice gives you clarity and confidence.

Here’s why speaking to a mortgage adviser is so important:

- You get access to more deals – many of the best rates aren't available directly from banks.

- You avoid costly mistakes – like picking a deal with hidden fees, or one that locks you in too long.

- Your application is stronger – advisers help you prepare your paperwork properly and improve your chances of approval.

- It saves time and stress – no jargon, no guesswork just expert help tailored to your situation.

- You may save thousands – by securing a better interest rate or avoiding early repayment charges.

Top benefits of using a mortgage adviser:

- Finding you the right deal by comparing mortgage rates from across the market best suited to your personal circumstances

- Save you time and money by handling the paperwork and avoiding costly mistakes and hidden fees

- Give clear, expert advice tailored to your situation - no jargon, no pressure just clear advice

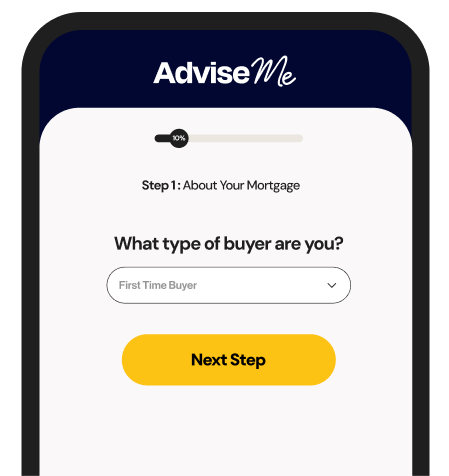

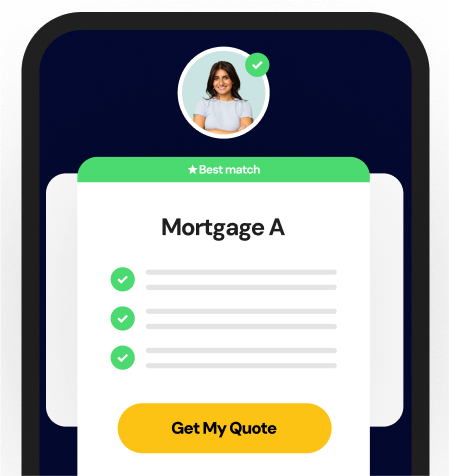

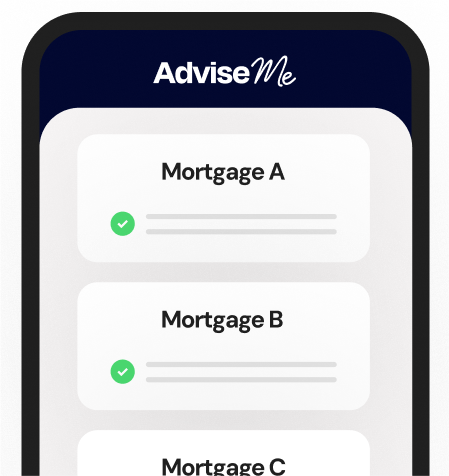

Get started today – it couldn’t be simpler

Applying for a mortgage might feel overwhelming but with the right support, it doesn’t have to be. Here’s how we make the process simple, step by step:

Our expert mortgage adviser network

We work with regulated mortgage advice firms, so you can rest assured you’re protected by the FCA, FOS, and FSCS throughout the process.

Frequently asked questions

Usually just before your current deal ends, so you avoid moving onto your lender’s more expensive variable rate.

Yes, but you might have to pay an early repayment charge. An adviser can help you weigh up the cost versus the savings

Often yes. A valuation confirms the property’s current value, which can affect the deals available to you.

Yes. Switching lenders can save money, provided any fees don’t outweigh the benefits.

You fill in a few details about what you’re looking for, and we’ll connect you with an FCA-regulated mortgage adviser. They’ll then talk you through your options, explain what’s available, and guide you towards the right deal for your situation.

No — your initial consultation is free. If the adviser charges a fee for arranging your mortgage, they’ll explain this clearly before you decide to go ahead.

Yes, we only work with mortgage advice firms that are authorised and regulated. This means they must follow strict rules set by the Financial Conduct Authority (FCA), including treating customers fairly and delivering good outcomes. Regulated advice also gives you protection through the Financial Ombudsman Service (FOS) and the Financial Services Compensation Scheme (FSCS) if something goes wrong.

We use secure systems and follow UK data protection laws to keep your information safe. Your details are only used to put you in touch with the right adviser and won’t be shared without your consent.