Find the best fixed rate mortgage deal for you

If you’re looking for the security of a fixed rate mortgage, choosing the right deal matters more than ever. A fixed rate gives you peace of mind knowing exactly what you’ll pay each month, with no surprises. But with rates and terms varying widely between lenders, the best option for you might not be the most obvious one.

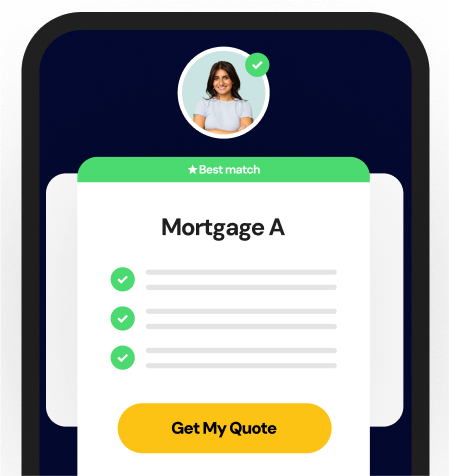

We connect you with expert mortgage advisers who compare fixed rate deals from across the market including many not available direct from lenders, to help you lock in the most suitable rate for your circumstances. Whether you're buying your first home, switching from an existing deal, or investing in property, they’ll help you find the right fixed rate without the hassle.

With professional advice and full support throughout the process, the advisers we work with can help you avoid hidden fees, confusing terms, and costly mistakes. 30% of borrowers overpay by not properly shopping around let’s make sure you’re not one of them.*

Why get mortgage advice?

Mortgages can be complex. The right advice makes a huge difference. Whether you’re new to mortgages or just want reassurance you’re getting the best deal, expert advice gives you clarity and confidence.

Here’s why speaking to a mortgage adviser is so important:

- You get access to more deals – many of the best rates aren't available directly from banks.

- You avoid costly mistakes – like picking a deal with hidden fees, or one that locks you in too long.

- Your application is stronger – advisers help you prepare your paperwork properly and improve your chances of approval.

- It saves time and stress – no jargon, no guesswork just expert help tailored to your situation.

- You may save thousands – by securing a better interest rate or avoiding early repayment charges.

Top benefits of using a mortgage adviser:

- Finding you the right deal by comparing mortgage rates from across the market best suited to your personal circumstances

- Save you time and money by handling the paperwork and avoiding costly mistakes and hidden fees

- Give clear, expert advice tailored to your situation - no jargon, no pressure just clear advice

Get started today – it couldn’t be simpler

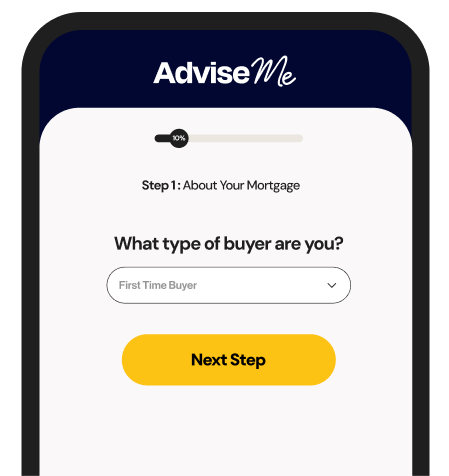

Applying for a mortgage might feel overwhelming but with the right support, it doesn’t have to be. Here’s how we make the process simple, step by step:

Our expert mortgage adviser network

We work with regulated mortgage advice firms, so you can rest assured you’re protected by the FCA, FOS, and FSCS throughout the process.

Frequently asked questions

It’s a mortgage where your interest rate stays the same for a set period, often 2, 3, 5, or 10 years.

Most lenders offer fixed terms of 2–5 years. Some also offer 7 or 10 years for extra certainty.

You’ll usually move onto your lender’s standard variable rate (SVR), which is often higher. That’s why many people remortgage before their fix ends.

Fixed rates give peace of mind on monthly costs. Variable rates may save you money if interest rates fall, but they carry more risk. The right choice depends on your circumstances.

You fill in a few details about what you’re looking for, and we’ll connect you with an FCA-regulated mortgage adviser. They’ll then talk you through your options, explain what’s available, and guide you towards the right deal for your situation.

No — your initial consultation is free. If the adviser charges a fee for arranging your mortgage, they’ll explain this clearly before you decide to go ahead.

Yes, we only work with mortgage advice firms that are authorised and regulated. This means they must follow strict rules set by the Financial Conduct Authority (FCA), including treating customers fairly and delivering good outcomes. Regulated advice also gives you protection through the Financial Ombudsman Service (FOS) and the Financial Services Compensation Scheme (FSCS) if something goes wrong.

We use secure systems and follow UK data protection laws to keep your information safe. Your details are only used to put you in touch with the right adviser and won’t be shared without your consent.