The journey to buying your first home starts here

Buying your first home is an exciting milestone but it can also feel a bit overwhelming. That’s where we come in. We'll connect you with leading expert brokers who will guide you through the whole process, from working out how much you can borrow to getting your mortgage approved and picking up the keys.

Our expert mortgage brokers will explain everything in plain English, compare the best deals from across the market, and handle the paperwork so you don’t have to. No guesswork, no jargon - just clear, honest advice tailored to you and your affordability.

It’s your first home. Let’s make sure it starts with the right mortgage.

Why get mortgage advice?

Mortgages can be complex. The right advice makes a huge difference. Whether you’re new to mortgages or just want reassurance you’re getting the best deal, expert advice gives you clarity and confidence.

Here’s why speaking to a mortgage adviser is so important:

- You get access to more deals – many of the best rates aren't available directly from banks.

- You avoid costly mistakes – like picking a deal with hidden fees, or one that locks you in too long.

- Your application is stronger – advisers help you prepare your paperwork properly and improve your chances of approval.

- It saves time and stress – no jargon, no guesswork just expert help tailored to your situation.

- You may save thousands – by securing a better interest rate or avoiding early repayment charges.

Top benefits of using a mortgage adviser:

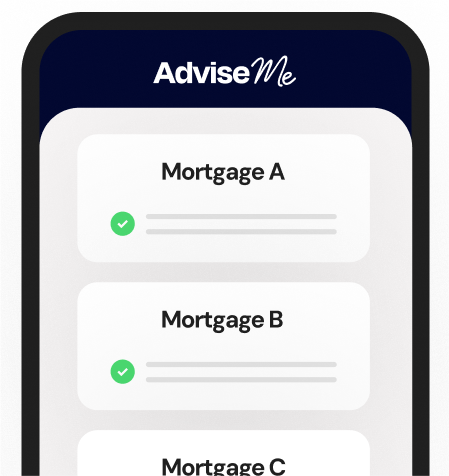

- Finding you the right deal by comparing mortgage rates from across the market best suited to your personal circumstances

- Save you time and money by handling the paperwork and avoiding costly mistakes and hidden fees

- Give clear, expert advice tailored to your situation - no jargon, no pressure just clear advice

Get started today – it couldn’t be simpler

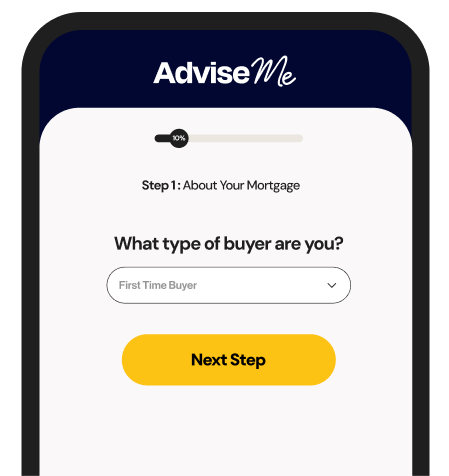

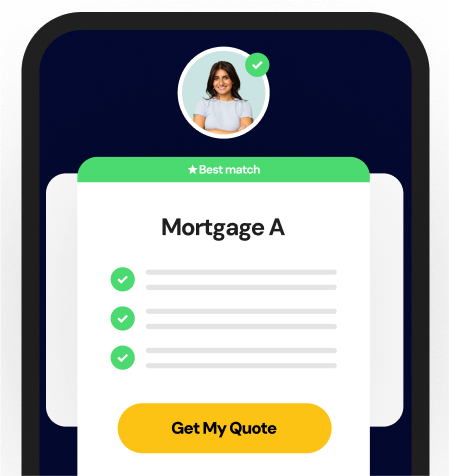

Applying for a mortgage might feel overwhelming but with the right support, it doesn’t have to be. Here’s how we make the process simple, step by step:

Our expert mortgage adviser network

We work with regulated mortgage advice firms, so you can rest assured you’re protected by the FCA, FOS, and FSCS throughout the process.

Frequently asked questions

Most lenders ask for at least a 5–10% deposit. Saving more can open up better rates and more choice.

Yes, it’s possible. Some lenders are more flexible if you can show stable income and responsible financial behaviour. An adviser can help you find the right options.

Options include 95% mortgages, Shared Ownership, and the First Homes scheme (discounted new-builds for eligible buyers).

No. The expert mortgage advisers we connect you with search the whole market, comparing deals from a wide range of lenders to find the right fit for you and your affordability.

Lenders assess your income, expenses, debts, and credit history to determine how much you can safely afford to borrow. The mortgage advisers we work with will help you understand this process so you can borrow responsibly.

Yes, though it usually requires more documentation like tax returns or business accounts. Our trusted advisers can connect you with lenders experienced in working with self-employed applicants and guide you through the process.

Besides the deposit, you may need to budget for valuation fees, legal fees, survey costs, stamp duty, and moving expenses. The mortgage advisers you’re connected with will help clarify these costs upfront.

Remortgaging means switching your mortgage to a new deal often with a different lender to get better rates or release equity. This can save money or raise funds without moving home. The mortgage advisers we connect you with can explain if this is a good option for you.