Save thousands with the right mortgage lender

Our specialist advisors don’t just compare rates. They understand lender criteria, manage the paperwork, and know how to get complex cases approved.

With deep expertise in specific mortgage types and strong lender relationships, they’ll save you time and give you the best possible chance of success.

Why get mortgage advice?

Mortgages can be complex. The right advice makes a huge difference. Whether you’re new to mortgages or just want reassurance you’re getting the best deal, expert advice gives you clarity and confidence.

Here’s why speaking to a mortgage adviser is so important:

- You get access to more deals – many of the best rates aren't available directly from banks.

- You avoid costly mistakes – like picking a deal with hidden fees, or one that locks you in too long.

- Your application is stronger – advisers help you prepare your paperwork properly and improve your chances of approval.

- It saves time and stress – no jargon, no guesswork just expert help tailored to your situation.

- You may save thousands – by securing a better interest rate or avoiding early repayment charges.

Top benefits of using a mortgage adviser:

- Finding you the right deal by comparing mortgage rates from across the market best suited to your personal circumstances

- Save you time and money by handling the paperwork and avoiding costly mistakes and hidden fees

- Give clear, expert advice tailored to your situation - no jargon, no pressure just clear advice

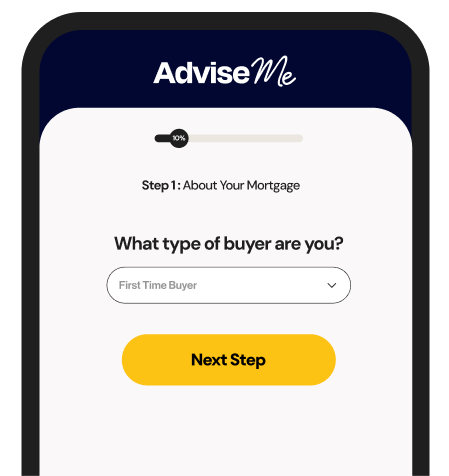

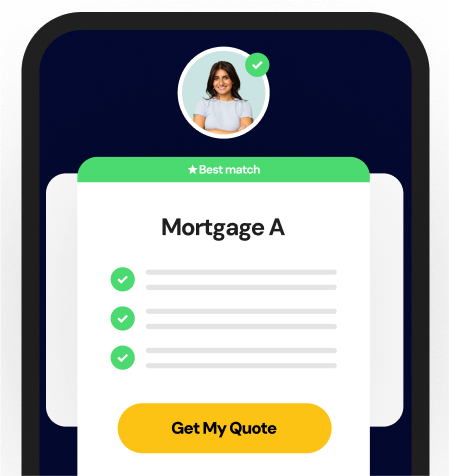

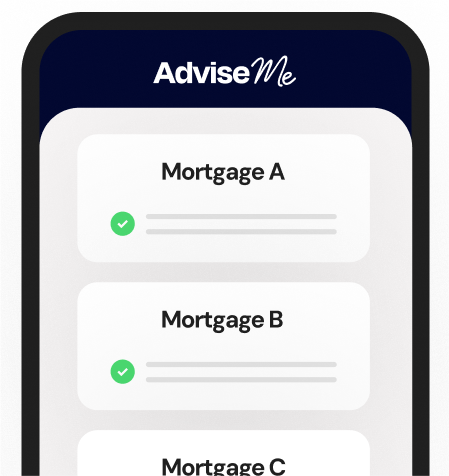

Get started today – it couldn’t be simpler

Applying for a mortgage might feel overwhelming but with the right support, it doesn’t have to be. Here’s how we make the process simple, step by step:

Our expert mortgage adviser network

We work with regulated mortgage advice firms, so you can rest assured you’re protected by the FCA, FOS, and FSCS throughout the process.

Frequently asked questions

Mortgage deals differ on interest rates, fees, and lending criteria. Some lenders may offer a low rate but add high arrangement fees, while others focus on flexibility such as overpayment options. Your deposit size, income, and credit profile all affect which deals you qualify for, so comparing across lenders helps reveal the true cost over the full term.

Yes. Remortgaging to another lender is common when your current deal is ending or if you find a more competitive offer. Switching can lower your monthly payments or give you more flexible features, but you’ll need to factor in early repayment charges, legal costs, or new arrangement fees before deciding if it’s worthwhile.

Yes. Lenders update their products frequently, sometimes weekly or even daily, depending on market conditions and interest rate changes. A deal available today might be withdrawn tomorrow, so comparing regularly and acting promptly can help you secure a favourable rate before it changes.

Each lender applies its own criteria around income multiples, credit scores, acceptable deposit sources, and property type. Some may accept self-employed income or smaller deposits, while others will not. Checking eligibility before applying helps you avoid unnecessary declines, which could impact your credit file.

You fill in a few details about what you’re looking for, and we’ll connect you with an FCA-regulated mortgage adviser. They’ll then talk you through your options, explain what’s available, and guide you towards the right deal for your situation.

No, your initial consultation is free. If the adviser charges a fee for arranging your mortgage, they’ll explain this clearly before you decide to go ahead.

Yes, we only work with mortgage advice firms that are authorised and regulated. This means they must follow strict rules set by the Financial Conduct Authority (FCA), including treating customers fairly and delivering good outcomes. Regulated advice also gives you protection through the Financial Ombudsman Service (FOS) and the Financial Services Compensation Scheme (FSCS) if something goes wrong.

We use secure systems and follow UK data protection laws to keep your information safe. Your details are only used to put you in touch with the right adviser and won’t be shared without your consent.