Take control of your financial future with Independent Financial Advice

Get expert guidance to make smarter decisions about your money.

Whether you’re planning retirement, looking to invest, or want a clearer picture of your financial future, speaking to an independent financial adviser can make all the difference.

In fact, 84% of people who received financial advice said it benefited their mental and emotional wellbeing, and 90% saw their quality of life improve in some way*.

That’s peace of mind, in real numbers.

Unlike tied advisers, independent financial advisers (IFAs) aren’t limited to a single provider. They look across the whole market to recommend what’s best for you. With independent advice, you get:

- Unbiased guidance tailored to your goals, not a product.

- Market-wide recommendations see all the options, not just one brand.

- Peace of mind with advice that’s FCA-regulated and in your best interests.

Why get Independent Financial Advice?

A regulated financial adviser is more than just a finance expert; they’re a long-term partner in your financial journey. Whether you’re planning for retirement, saving for something special, or navigating a life change, they can help with:

- Understanding your pension and retirement options

- Creating a personalised financial plan

- Navigating complex decisions like inheritance, tax planning, or long-term care

- Making smarter investment and savings choices

- Budgeting for today and planning for tomorrow

And it’s not just about the numbers. It’s about having someone who understands your circumstances, listens to your goals, and gives you the tools to get there.

The advice difference:

- 33% felt more confident

- 26% worried less about money

- 25% felt less vulnerable

- 20% even slept better at night

Whether it’s helping you plan for retirement, deal with unexpected life changes, or simply make the most of your pension, financial advice makes a real difference.*

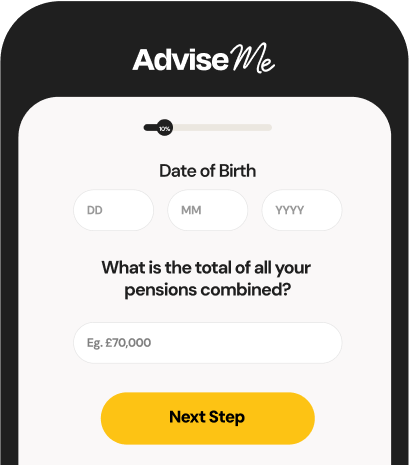

How our service works

Why use our service?

Making decisions about your financial future is important, and getting the right advice can make all the difference. Our service connects you with trusted, FCA-regulated advisers who are ready to help you navigate your financial planning journey.

- Free and impartial - There’s no charge for using our service. We’ll match you with a qualified adviser at no cost to you.

- Quick and convenient - It takes less than a minute to be matched with an adviser who understands your needs.

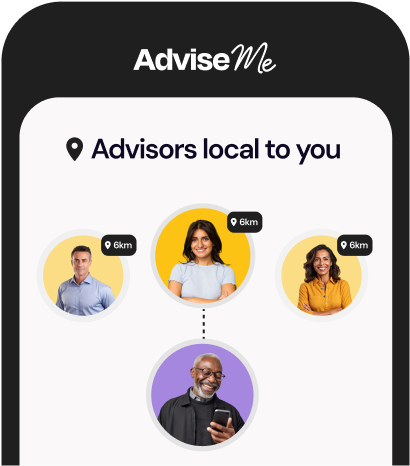

- Advisers near you - Our nationwide network means you’ll be connected with someone local, so you can choose how and when to speak.

Our expert adviser network

- A history of delighted customers and outstanding service.

- Consistently approachable and responsive, so you never feel ignored.

- All of the advisers we work with are FCA-authorised and regulated.

- Provide service with honesty, reliability and respect.

- We’ve a long history of connecting customers with local experts.

- We work harder and smarter behind the scenes to find your expert match.

*Based on a report conducted by St. James's Place Wealth Management Plc in 2024

Frequently asked questions

If you’re making big financial decisions like planning for retirement, investing, reducing tax, or managing inheritance; professional advice can help you avoid costly mistakes and make smarter choices for the future.

Your initial consultation is free and without obligation. If you decide to proceed, fees vary depending on the adviser and the type of service you need. All costs will be explained clearly upfront, so there are no surprises.

All of the advisers we work with are governed by FCA rules. Their firms are authorised and regulated by the Financial Conduct Authority (FCA). This means both they and their firms must follow strict professional standards, with a legal duty to:

-

Treat you fairly

-

Provide clear, good-value advice

-

Put your financial wellbeing first

With FCA oversight, you can feel confident that the advice you receive is designed to help you achieve the best possible outcomes.

You can choose what works best for you. Many advisers offer secure video or phone consultations, while others are happy to meet face-to-face.

A financial adviser can support you with:

- Retirement and pension planning

- Tax-efficient investing

- Estate and inheritance planning

- Wealth management strategies

- Reviewing existing financial products

Yes. We don’t charge you to be matched with an adviser. You’ll get a free initial consultation, and only pay fees if you decide to go ahead with the adviser’s recommendations.